Cricket Country Staff

Editorial team of CricketCountry.

Written by Cricket Country Staff

Published: May 06, 2020, 10:14 AM (IST)

Edited: May 06, 2020, 10:14 AM (IST)

Kolkata Knight Riders (KKR) owners are exploring the opportunity to invest in England and Wales Cricket Board’s (ECB) ambitious tournament The Hundred.

The Hundred is cricket’s newest format comprising 100-balls-per-side and will see the participation of eight franchisees. However, the competition, to be played in July this year, has been postponed in the wake of the ongoing coronavirus pandemic.

A consultancy group has already recommended ECB to convert “its revenue distributions to counties into equity stakes and gifting these to each county” and thus opening it up to potential private investments.

The idea of private investments wasn’t in the agenda when the event was being conceptualised but with the financial turmoil arising out of the current health crisis, ECB is reconsidering its stance.

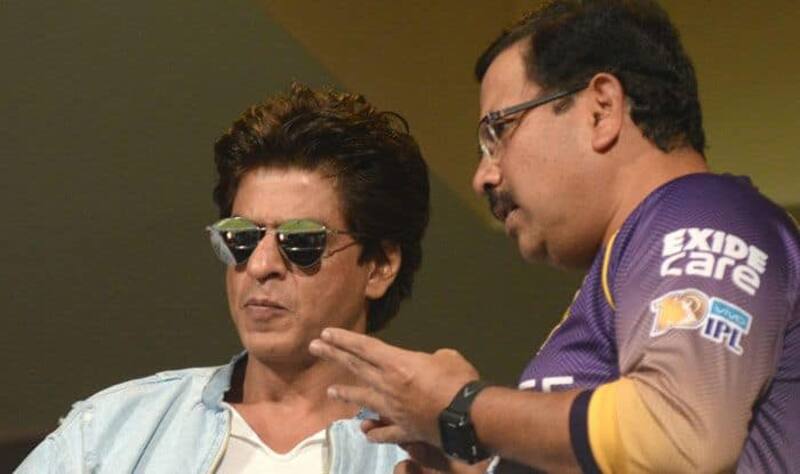

IPL franchise KKR, which is co-owned by Bollywood actor Shah Rukh Khan, are reportedly among several potential investors. “We are perhaps the only genuine global brand in cricket and our strategy has always been to look at opportunities to invest in cricket globally,” KKR CEO Venky Mysore was quoted as saying by The Telegraph.

“All leagues around the world understand the value that Knight Riders bring to any league and to that extent we will surely be keen to explore [investment opportunities]. I think leagues are also realising the value of having investors such as us who bring our brand, professional management, marketing ideas and huge fan base,” he added.

ECB has said it’s expecting to lose around 380m should the entire cricket calendar for the summer is wiped out.

“We anticipate, with no cricket this year, a worst-case scenario could be as bad as 380m,” ECB CEO Tom Harrison said. “With a following wind, hopefully we will be able to play a significant number of Test matches this summer, which will helps us mitigate those financial losses that we are facing at the moment.”

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.